Every potential tenant should be thoroughly screened no matter how great they appear on paper or in person. It is not uncommon for even experienced property owners to let a great first impression about a potential tenant guide their decision to go ahead and enter into a lease and hand over the keys to a property without further screening. Remember, you want to find the most qualified and best tenant for your property and the best way to ensure that is to properly screen potential tenants.

You must specifically have the authorization to contact prior landlords, employers, and to pull and review credit and criminal histories. You must keep any information you obtain protected and private as you are digging into and will be receiving highly personal information. Make sure you obtain written authorization by including authorization forms as part of the rental application. Obtaining these prior authorizations will protect you by ensuring you are abiding by the privacy laws in California. At Patrize Properties, we handle all aspects of disclosing and performing a full screening check on each applicant.

The following are things you should absolutely do in order to complete a thorough tenant screening:

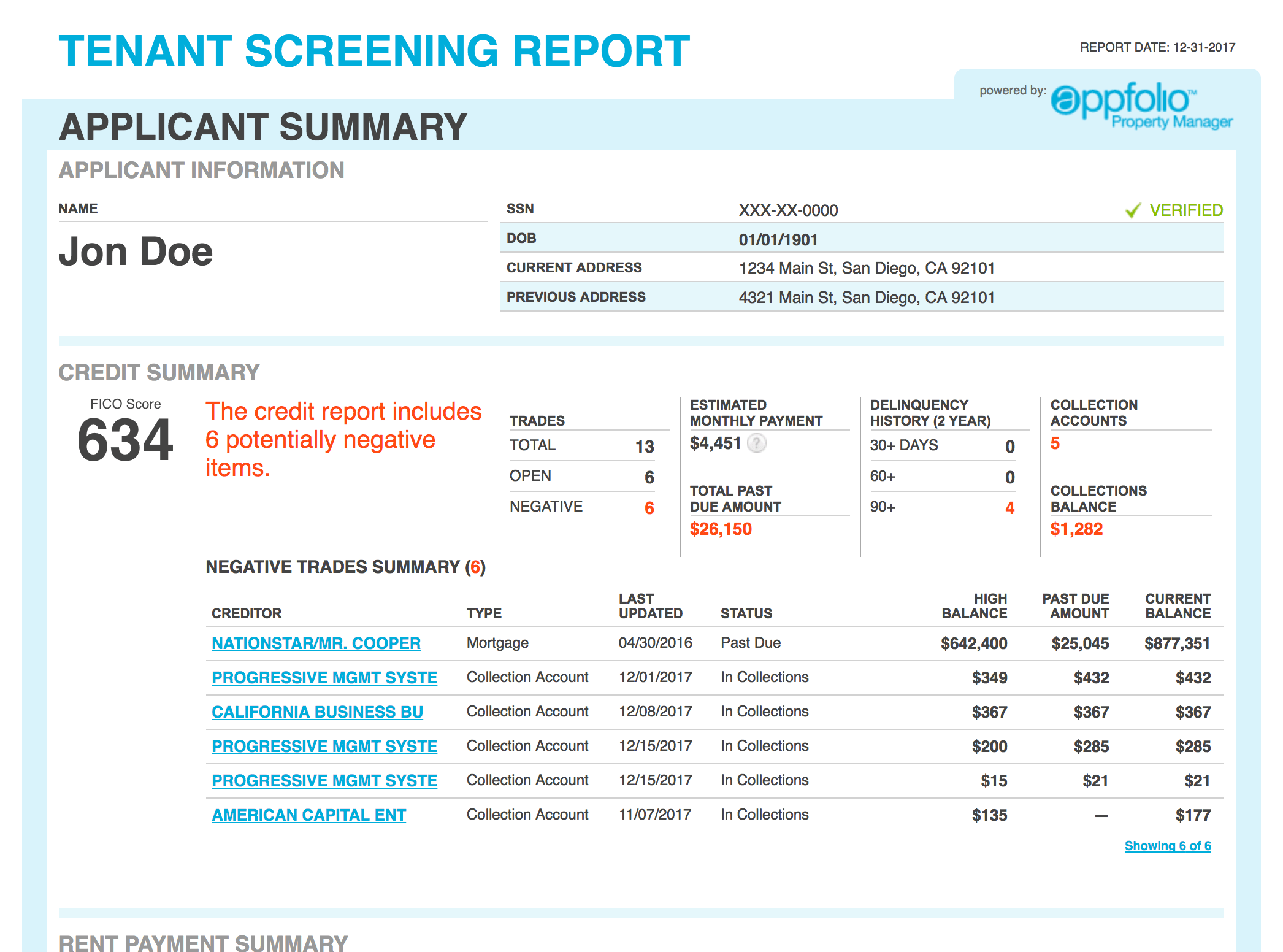

Perform a credit check

A credit report will reveal judgments; how much debt a potential tenant is carrying; who is inquiring about their credit; bankruptcies; and if they have a tax lien against them. While a credit check will not necessarily list any past evictions it will include collection accounts for unpaid rent or lease payments a former landlord has pursued. If a judgment is listed on the credit report the facts of the case will be public record and you will be able to ascertain if the judgment involved an eviction or the breaking of a lease if you choose to look up the case history at the court in which it was heard. (And don’t forget to obtain prior authorization from a potential tenant before pulling and reviewing their credit report.)

Perform a criminal background check

This step is especially important if your property consists of multiple units or is located in a building with multiple units. While not all crimes are relevant, you certainly do not want to deal with someone who might be violent or allow someone with a history of theft to have access to a building full of potential victims. This step might also help to reduce your liability should your tenant harm another person or person’s property while living in a shared building. And do not worry about offending potential tenants by requiring a criminal background check because good tenants will not be averse to being checked out. It also sends the message to prospective tenants that you do everything you can to keep bad people out of your properties. Keep in mind, according to TransUnion, 22% of tenants who allowed criminal background checks in 2015 had a criminal history (And don’t forget to obtain prior authorization from any potential tenant before pulling and reviewing their criminal history.)

Verify employment history

Most renters’ applications include a section for employment history, yet often time property owners fail to use that information. Take the time to actually contact the employers listed to verify the information provided you. Although for privacy and liability reasons employers will only typically be willing to confirm whether or not the employee is currently employed, contacting them allows you to validate that the potential renter has a job and that it is the job

listed on the application.

Before blindly calling the phone number listed on the application, google the phone number or company website to ensure that you are contacting the listed place of employment and not a friend of the potential tenant. Contacting employers takes time but will screen out dishonest potential tenants and potential tenants that might not be able to afford the rent. (And be sure that you have written authorization prior to contacting the employer(s) listed.)

Verify the amount of income listed

Verifying the amount of income a potential tenant has listed is important to ensure they are able to afford the rent. At the minimum, you should require a potential tenant’s two most recent paystubs. If the potential tenant is self-employed, ask them for their most recent bank statement showing all deposits going into the account. You want to ensure that their income is at least 2.5 times the rent – net amount, not gross.

Verify rental history

Ideally, you want a prospective tenant to provide you with at least three years of rental history. Once you have written authorization to contact past landlords use the provided information to actually contact those past landlords (especially those prior to the current landlord) to obtain the following information:

- Did the potential tenant pay the rent on time?

- Did they ever bounce any checks?

- Was the property left in good condition?

- Were there any complaints made about them?

- What was the rent amount?

- When did they move in and out?

- Did they provide proper notice when they decided to move out?

- Would the prior landlord rent to them again?

Only after completing a thorough screening should you contact the potential tenant and offer to rent them your property. Discuss with them what is expected of them during the tenure of the lease and what they should expect from you, the landlord. Once you have both verbally agreed to the terms, provide them with the lease and collect the deposit. And remember, if the move in date is set for a later date wait to end showings of the property until you obtain the signed lease and collect the deposit in certified funds.